Matty

Keto Life

- Since

- Jan 26, 2010

- Messages

- 54,619

- Score

- 9,462

- Tokens

- 50

Matty your above calculations are working on a hashrate of 100MH/s.

Re-calculate the figures using a hashrate of 60000MH's (60GH/s) and tell me it doesnt add up.

Why are these that retailed for $1200 a couple of months back now going for 8k+ on ebay if the numbers dont add up?

I don't know, I haven't looked into mining at all, just going from what I read at bitcointalk.

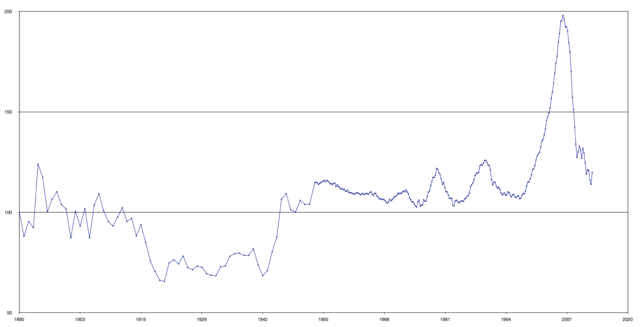

I really think the bitcoin "bubble" is nowhere close to being burst.