What is that sovereign man site about rogue? Looks interesting.

It was actually a woman who told me about two of the coolest sites I have used in the past year, pulse and clipboard. I think women read alot more on kindle and pads and are alot better at spotting good design, pulse and clipboard have so much better interfaces than google reader. Perfect for a pad. I mainly use these two sites now and my email, you can take all your bookmarks and turn them into something like reading a daily newspaper or magazine with all your bookmarks and most visited sites.

Pulse is a news reader like google reader and is a news and rss feed aggregator, you put in all your newspapers and most websites you visit often and it arranges them in an easy to read tile interface with the daily news but you can put up regular web sites as well. Beautiful to look at on a pad but but I use it on my desktop to check out most of my bookmarks like a magazine. Pretty easy to transfer most of your bookmarks.

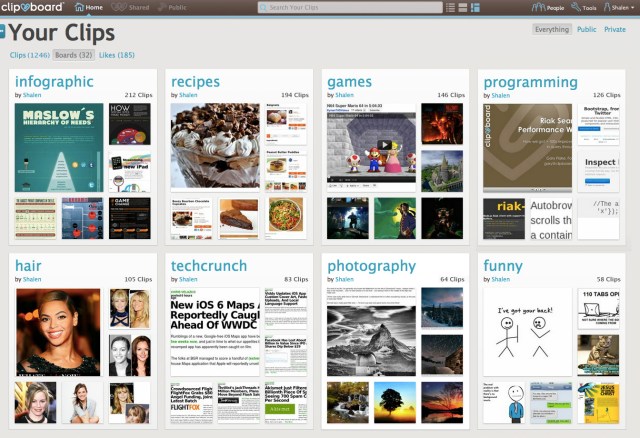

My friend told me about clipboard, she said it was alot like a site she uses called "pinterest", clipboard is alot more than a news reader, you cant get the feeds like pulse but it you can clip any sort of image from any site and is available for almost any site unlike pulse. I use it for stuff I see on ebay and alot of people use it for recipes, flight deals,etc. I use it the same way I use pulse, as a way to arrange all my bookmarks to read them like a daily style newspaper/magazine. Between the two you save a ton of time on the internet wasting time getting sidetracked sludging through some crap on huffington post or cramming your mail box full with links and stuff to remember.

https://clipboard.com/

I have both pulse and clipboard set up sort of like these examples

I have my bookmarks for bbc, time asia, takis mag, washington post etc, in the news section

Stock stuff in that section

At my age , my porn stuff is primarily real estate porn and looking up awesome pads in the architecture blogs or on places like curbed or just reading one of those luxury blogs like luxuo

http://www.luxuo.com/ or

http://www.luxury-insider.com/.

food porn

http://dc.eater.com/

Horse racing stuff in one section, boating stuff in one section, in tennis section I have tons, this is one of the best tennis sites on the internet

http://heavytopspin.com/. Pulse and Clipboard will save you tons of time on the internet